In 2024, the first footwear and apparel brand, Amer sports, will be listed in the United States, with commendable performance in climate sustainability. How are the carbon reduction targets progressing and performing for major brands?

01 Amer Sports is going public in the United States. How is its climate sustainability performance?

recently submitted its IPO documents, applying for listing on the New York Stock Exchange. As a subsidiary of Anta, Amer Sports, home to ARC‘TERY and Salomon, along with Lululemon, is often referred to as the "new middle-class trio" due to its combination of fashion, quality, and performance, making it highly popular among consumers. How is their climate sustainability performance?

Amer Sports Brand Portfolio

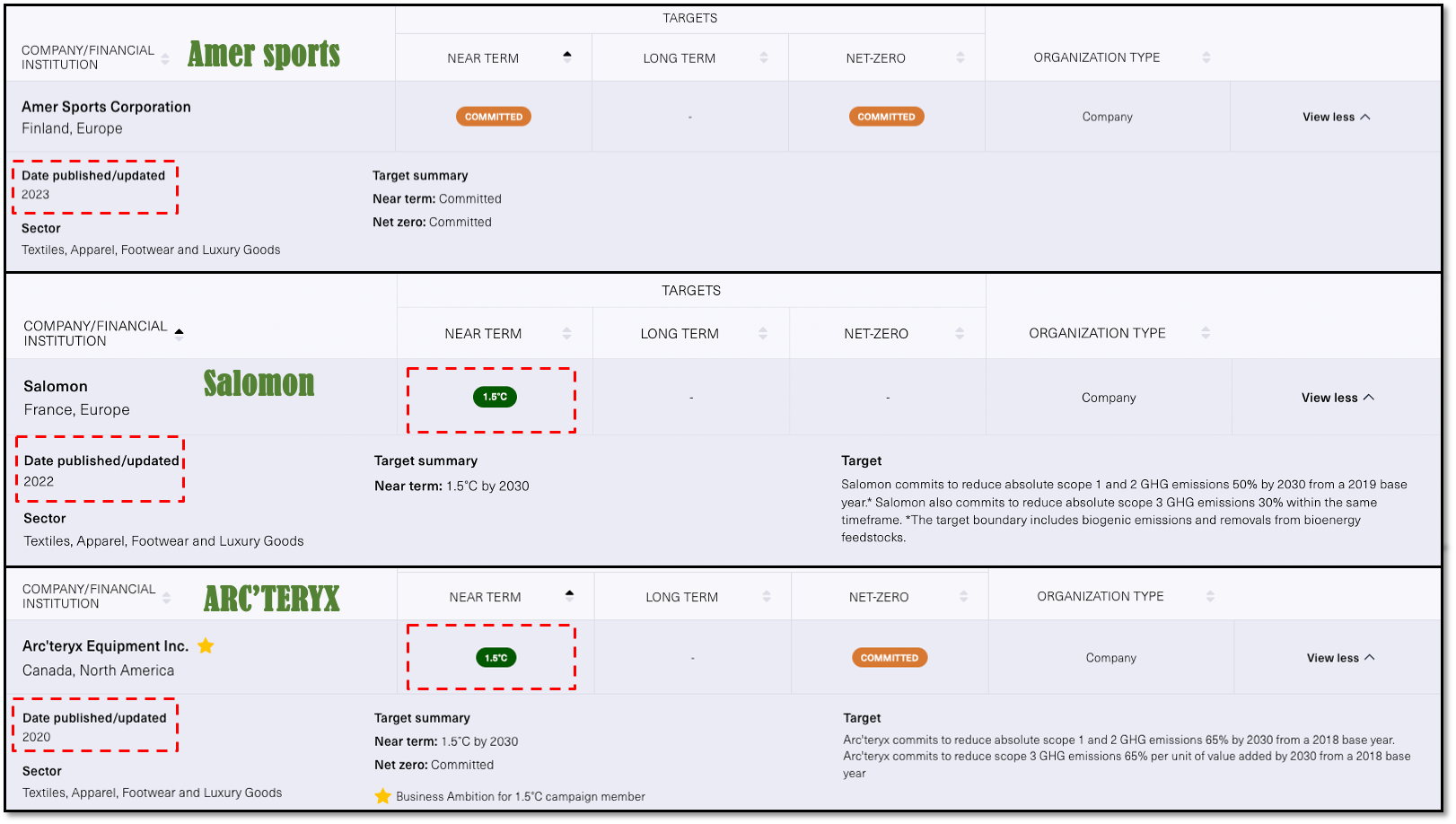

Since Anta's acquisition of Amer Sports in 2019, the pace of sustainable development for Amer Sports and its subsidiary brands has not only not stagnated but has become more robust. In 2023, Amer Sports submitted its Science-Based Targets (SBTi), with the previous SBTi goals of its brands Arc'teryx and Salomon already successfully verified.

Source: SBTi official website, CarbonNewture compilation

The parent company (Amer Sports) proposed carbon targets later than its subsidiaries (ARC‘TERY and Salomon), precisely in the year before going public. This is closely related to the current requirement for publicly traded companies to disclose their ESG information. It is not difficult to see that this move is also paving the way for Amer Sports' listing.

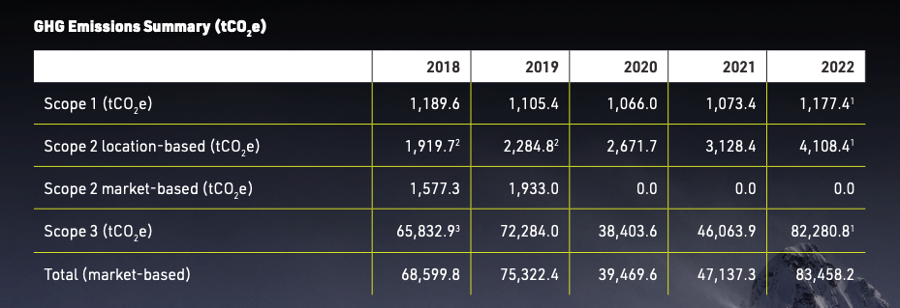

To achieve SBTi carbon goals, accurate quantification of corporate carbon emissions is crucial. As shown in the figure below, ARC‘TERY disclosed carbon emission data in the "2022 Climate Action Report," accounting not only for Scope 1 and Scope 2 emissions but also for Scope 3 emissions (including purchased goods and services, upstream transportation and distribution, business travel, and employee commuting, among six categories).

The "2022 Climate Action Report" published by ARC'TERYX

In addition, Amer Sports has also joined the Supply Chain Decarbonization Project (SCDP) initiated by the European Outdoor Group. Launched in early 2021, this project involves a three-stage process where members undergo assessments within their supplier networks and audits by external partners. As many brands share common upstream suppliers, the collaborative efforts of major brands have a synergistic impact on decarbonizing the supply chain.

Brands that have joined the SCDP.

At the same time, ARC'TERYX, Salomon, and Peak Performance, subsidiaries of Amer Sports, are signatories to the United Nations Fashion Industry Charter for Climate Action . Together with other brands, they are committed to limiting global warming to below 1.5 degrees and achieving net-zero emissions by 2050.

Fashion Industry Charter for Climate Action (Source: UNFCCC Official Website)

In summary, before Amer Sports goes public in the US, it has already established a solid foundation for sustainable development. This lays a strong groundwork for its ESG performance (ESG is considered the fourth financial statement for companies). Amer Sports and its subsidiary brands continuously enhance their climate sustainability performance through carbon target setting, carbon data accounting, supply chain decarbonization, and collaborative efforts with industry brands to address global climate change. This serves as a valuable example for the industry to learn from.

02 Reviewing the carbon targets of major fashion brands

In recent years, the global wave of ESG (Environmental, Social, and Governance) has swept many companies onto the "beach," forcing brands to confront climate challenges and actively engage in low-carbon transformations. As major brands enter the climate sustainability race, the competition becomes intense. Only by standing at the forefront of climate change, embracing change, and leading the way in the dual carbon era can they succeed.

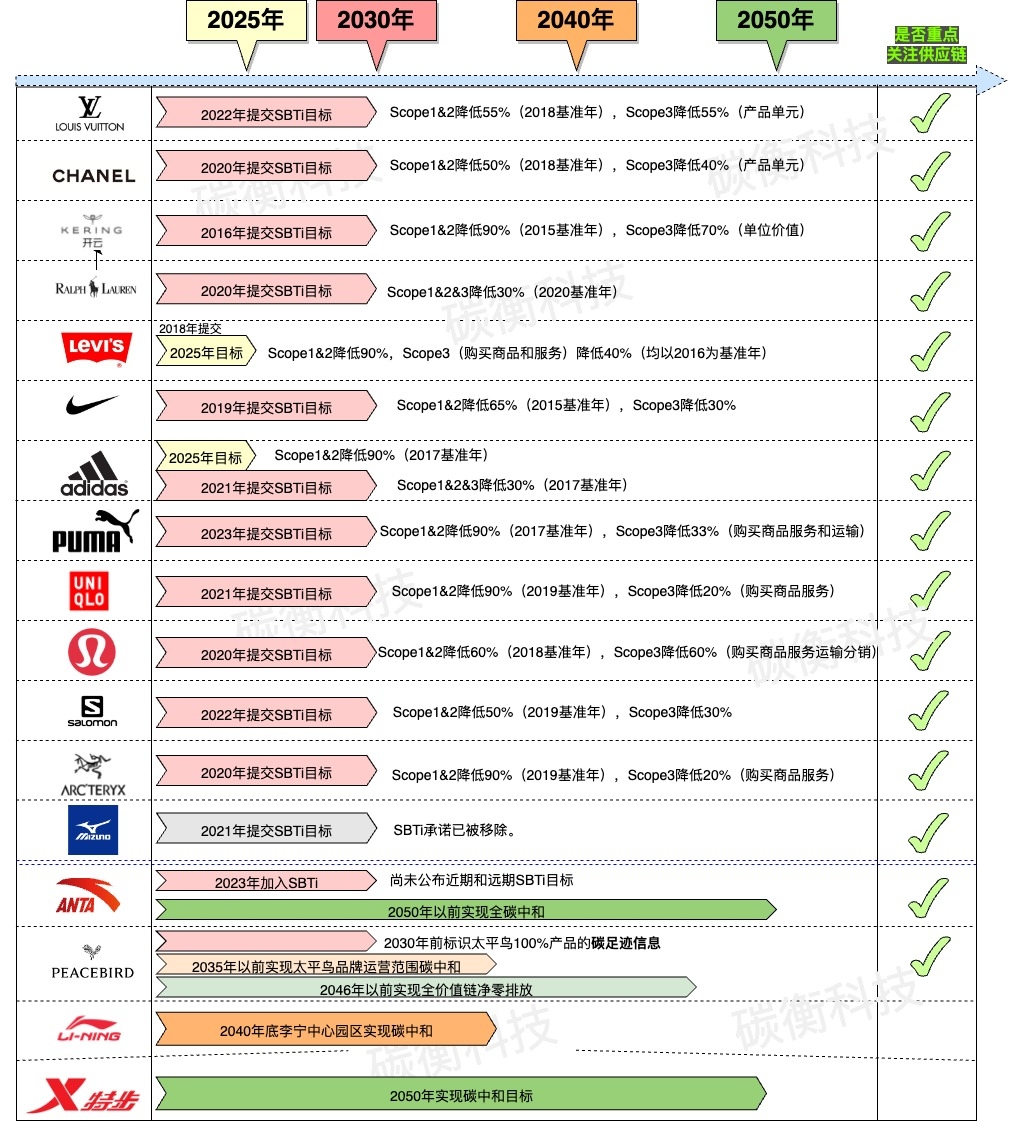

The chart below summarizes the "carbon targets" set by some global fashion brands. Since 2016, leading international brands have been setting SBTi (Science-Based Targets initiative) carbon goals, with the majority setting 2030 as the cutoff point for short-term goals. Most brands have already started to focus on decarbonization efforts within their supply chains.

The summary chart of carbon targets for major brands, designed by CarbonNewture

One of the luxury goods giants, Kering Group, had already set carbon targets back in 2016, aiming to reduce Scope 3 carbon emissions by 70%, a leading initiative compared to most companies. Levi's plans to achieve its near-term target by 2025, setting a baseline year in 2016. The goal includes a 90% reduction in Scope 1 & 2 carbon emissions and a 40% reduction in Scope 3 emissions (purchased goods and services). As the target year (2025) approaches, let's wait and see.

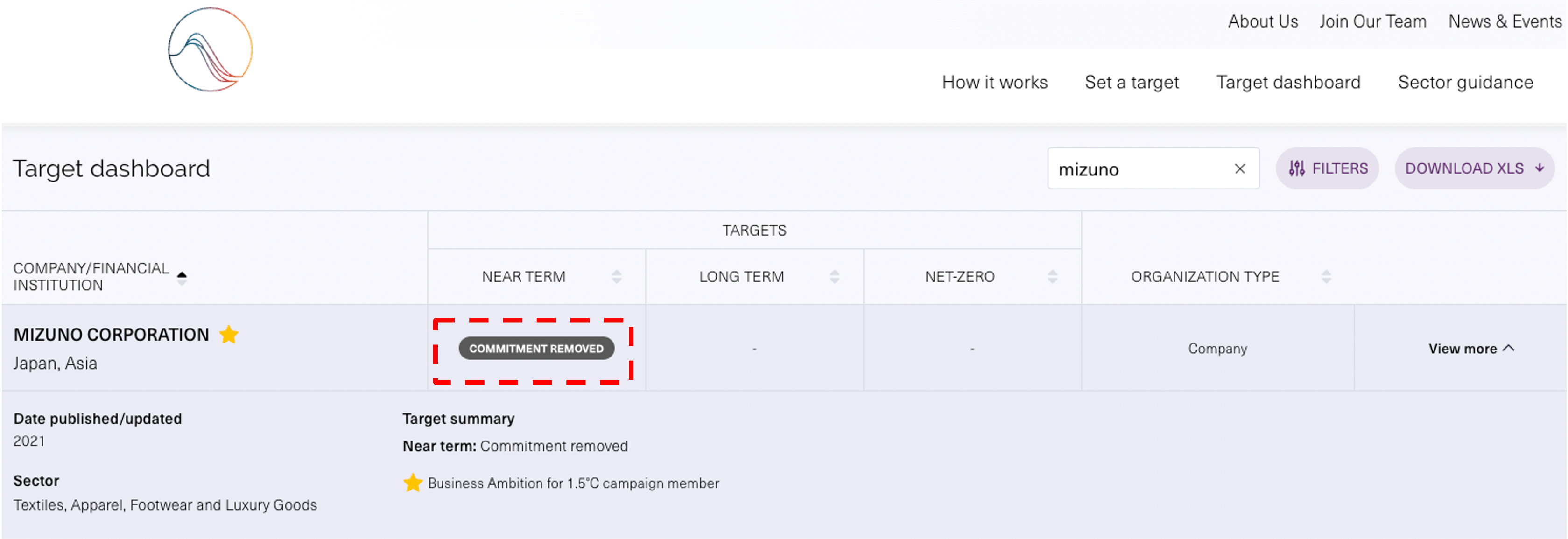

It's worth mentioning that the Japanese brand MIZUNO set SBTi targets in 2021 but is currently listed as "COMMITMENT REMOVED," possibly indicating that its carbon targets have not been verified by SBTi.

MIZUNO's SBTi targets have been removed, as captured from the SBTi official website

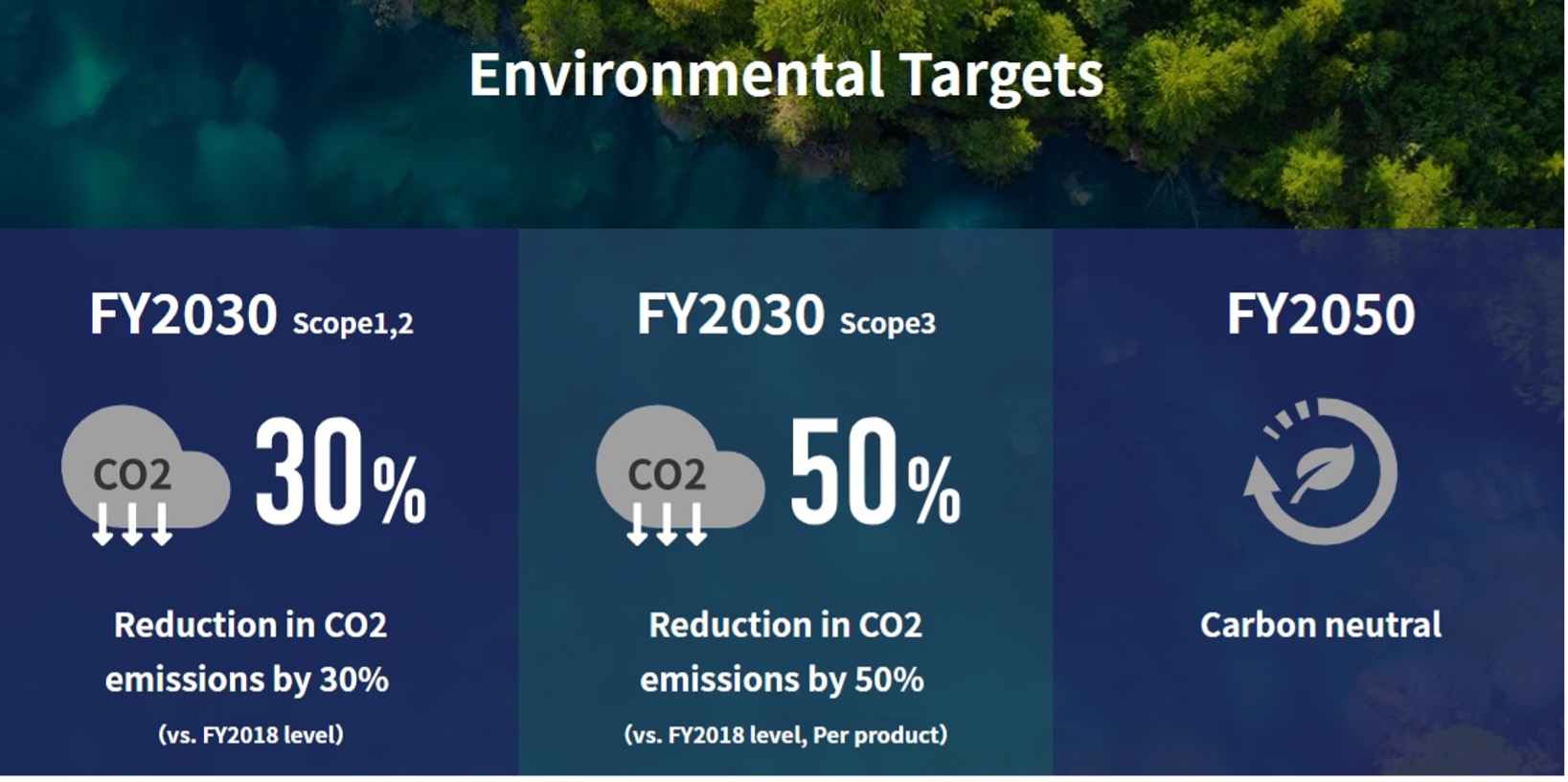

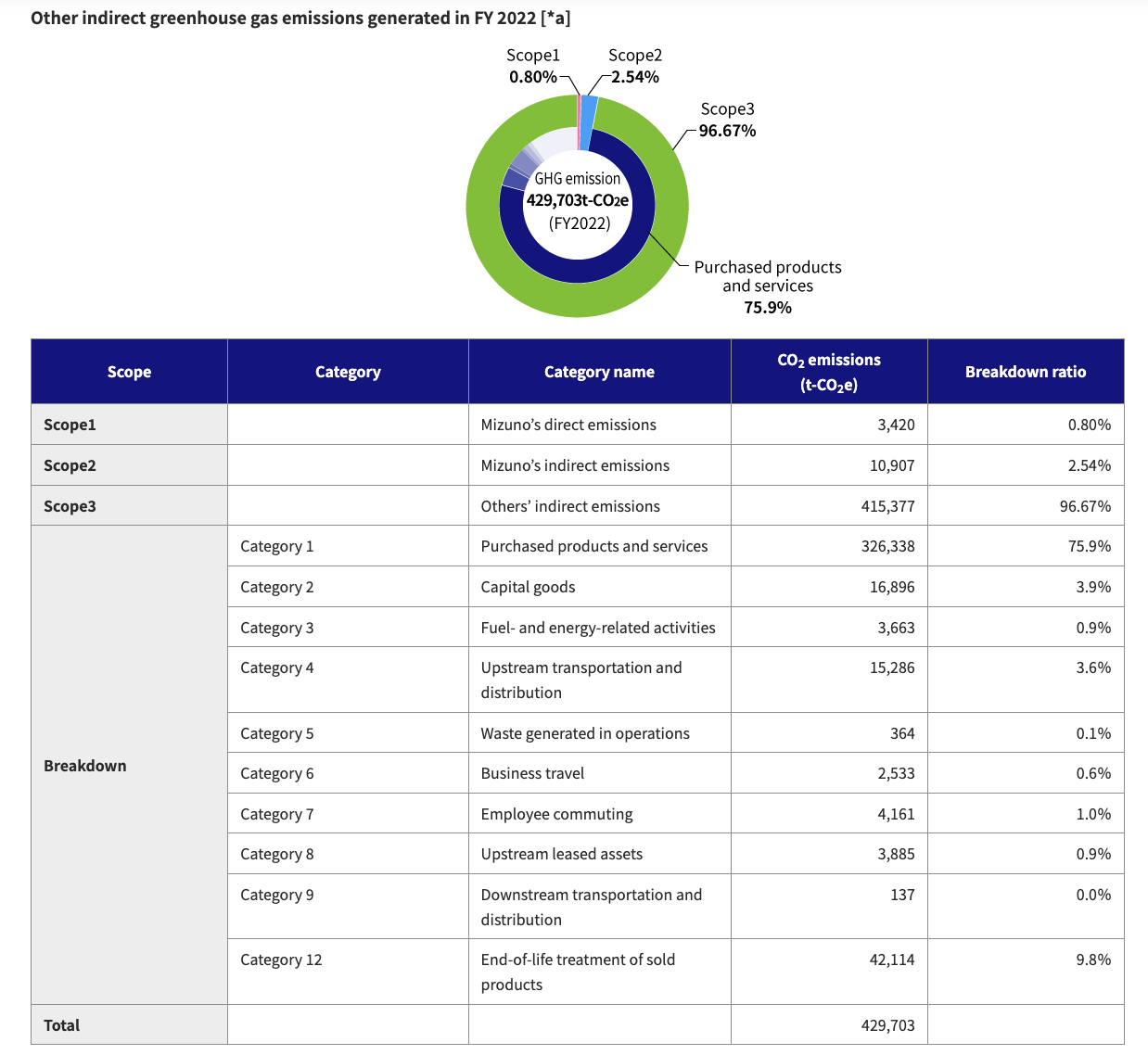

Currently, MIZUNO has disclosed its carbon neutrality goals and carbon emission data on its official website. The carbon targets are set as follows: by 2030, a 30% reduction in Scope 1 & 2 carbon emissions and a 50% reduction in Scope 3 emissions (product units), aiming to achieve carbon neutrality by 2050. Based on the published data, carbon emissions calculations encompass Scope 1, 2, and 3, with Scope 3 including 12 categories such as purchased goods and services. From the scope of accounting, MIZUNO's emphasis on supply chain decarbonization is evident.

MIZUNO's carbon targets, sourced from the Mizuno official website.

MIZUNO's carbon targets, sourced from the MIZUNO official website.

Let's take a look at the performance of domestic companies. Starting with Anta, the parent company of Amer Sports, besides facing domestic industry pressure for low-carbon transformation, Anta's global presence also compels it to confront climate issues. Although it joined SBTi in 2023, its carbon targets have not been verified yet. Anta's current disclosed carbon target is to achieve carbon neutrality by 2050, but further details such as short-term goals and value chain decarbonization plans have not been publicly disclosed.

Similarly, Li-Ning and Xtep, as sports brands, have disclosed ESG reports, but their discussion on carbon targets remains general. Publicly available information does not mention core objectives or specific plans for carbon targets (refer to the summary chart of carbon targets for major brands mentioned earlier for specific carbon goals).

Among the many domestic brands, Peacebird stands out. Not only has it set phased "dual carbon" targets, but it has also committed to identifying the carbon footprint information of 100% of Peacebird products by 2030. While product carbon footprints and corporate Scope 1, 2, and 3 carbon emissions may differ, they can link the entire industry's carbon data. Additionally, product carbon footprint information serves as the data foundation for carbon reduction in the industry chain, making it an important focus of China's dual-carbon strategic planning. Furthermore, domestic brands such as K-boxing, Hongdou Group, Bananain, and Embryform have also undertaken significant work related to carbon footprints and carbon labeling.

n general, the climate sustainability performance of domestic brands may not be on par with some international counterparts. However, they have made certain achievements in terms of product carbon footprints and carbon labeling. With the guidance of policies and the growing internal demand for sustainable development within companies, domestic brands are positioned to potentially catch up and excel in the field of climate sustainability.